Today, technology can zip your restaurant order to the kitchen in an instant, allow you pay your taxi fare by credit card, and let you scan your groceries as you place them in your cart. Welcome to the world of mobile point-of-sale systems. Wireless connections are in the process of altering the way we shop. And the trend continues to grow.

Point of sale (POS) is business lingo for the spot where a retail transaction takes place — where money changes hands. Though today many people pay for things with credit or debit cards, most payments used to be made by cash or check, and merchants stored the money in a cash drawer or box. Then along came the cash register. Invented in the 1870s, it was a mechanical way to keep track of revenues and was the first POS system.

Not much changed until the 1970s when the next POS innovation — the barcode — became available. Beginning in 1974, Universal Product Codes began to appear on items. Merchants were able to use scanners to read these codes and process sales more quickly and accurately [source: National Barcode]. In the past 20 years, retailers have added a few more gadgets to speed checkout lines, including card swipe devices for accepting credit and debit cards, as well as signature pads and personal identification number (PIN) pads.

During the 1990s, wireless computer networks — which send radio waves through the air to transmit data — became available, allowing POS systems to go mobile. Restaurants were among the first to adopt this new technology. They accelerated the payment process by letting staff process credit cards at customers’ tables. Other businesses followed suit. Car rental companies, for example, added mobile POS to allow curb-side handling of car returns. Hotels sent servers poolside to take guests’ drink orders on mobile devices.

Some retailers are now replacing centralized checkouts and letting clerks use portable computers to complete transactions. Many Apple stores, for example, which sell Apple computers and other hard- and software, have gotten rid of cash registers. Representatives answer customers’ questions, check stock and finalize sales with hand-held devices [source: First Data].

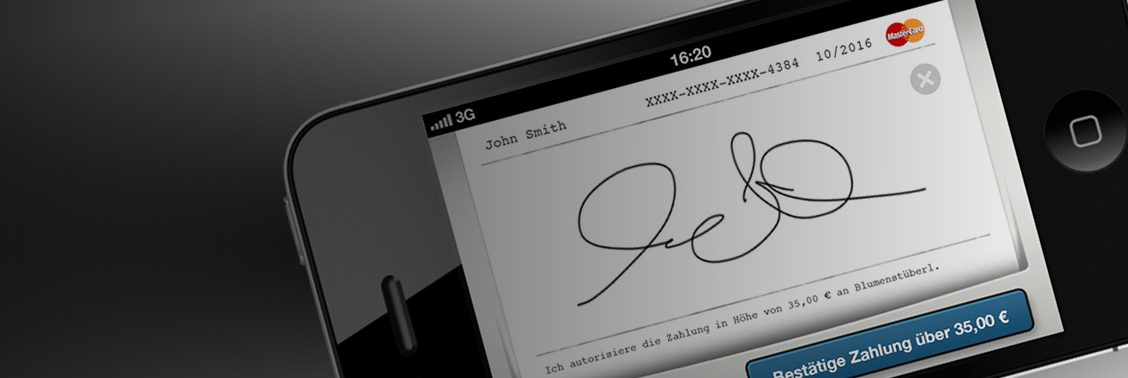

Mobile POS can be especially useful in the field. For example, the Hampton Jitney bus service, which carries New Yorkers to Long Island beach communities, uses an onboard system that allows attendants to check reservations, take payments and print out receipts [source: Zebra.com]. Today, there are also systems that allow small-scale merchants like flea market vendors and bake sale operators to accept credit cards and process transactions using an ordinary mobile phone [source: Extended Retail Solutions].

Though some have concerns about the security of wireless transactions, both consumers and merchants may benefit from the availability of mobile POS. Retailers and service companies can make employees more productive and lower labor costs. A restaurant server, for example, can save considerable legwork with fewer trips to the kitchen or cash register. Also, accuracy is increased by eliminating written orders. Customers may receive speedier service and error-free, detailed receipts on the spot.